BMBF Forschungsprojekt „SATISFY“

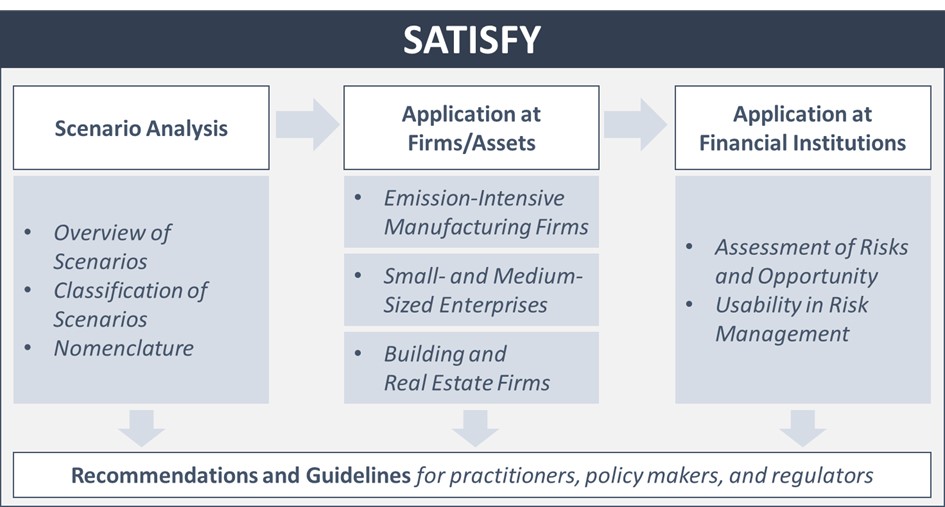

Scenario Analysis as a Tool for InvestorS, Firms, and regulators on the path to climate neutralitY (SATISFY)

The Frankfurt School – UNEP Collaborating Centre, the German Institute for Economic Research, and Justus Liebig University Giessen jointly conduct research on scenario analysis as a tool on the path to climate neutrality. The three-year project SATISFY (Scenario Analysis as a Tool for InvestorS, Firms, and regulators on the path to climate neutralitY) will produce insights into how investors, firms, and regulators can use scenario analysis in the climate transformation of business models and the entire economy.

The structural transformation to achieve a climate-neutral economy induces risks and opportunities at the firm and the financial-system-level. Analysing and shaping the transition to a net-zero economy requires a forward-looking perspective. Scenario analysis is an important tool to detect and understand the potential implications of these climate-related structural changes. However, current approaches of applying scenario analyses show several deficiencies. Most importantly, current applications usually employ a top-down assessment of the transitional risks and typically do not go beyond the sectoral level.

The project SATISFY will analyse how scenario analysis can serve as a tool to assess, manage, and communicate firm-specific climate risks and opportunities and hence support the transition towards a net-zero economy. The use of scenarios will be analysed for three firm/asset types which are all crucial for the transformation:

- emission-intensive manufacturing firms,

- SMEs, and

- buildings / real estate firms.

Finally, SATISFY will bring the firm/asset level analysis to the financial institution level to understand how the financial sector can assess their risks more precisely. The project members will produce academic papers, policy briefs, and will invite experts for exchanges.

Publications and Work in Progress:

- Are sustainability-linked loans designed to effectively incentivize corporate sustainability? A framework for review (with Alix Auzepy, Christina E. Bannier and Fabio Martin), 2023, Financial Management

- Evaluating TCFD reporting - a new application of zero-shot analysis to climate-related financial disclosures (with Alix Auzepy Auzepy, Christoph Funk, David Lenz and Elena Tönjes), 2023, PLOS One

- Integrating Climate-related Risks into Banks' Risk Management: Status Quo & Opportunities (with Alix Auzepy and Christina E. Bannier)

SATISFY is part of the research fund Klimaschutz und Finanzwirtschaft (KlimFi) by the Federal Ministry of Education and Research (BMBF).

Project partners:

-

Frankfurt School of Finance & Management and

Frankfurt School - UNEP Collaborating Centre for Climate & Sustainable Energy Finance -

German Institute for Economic Research (DIW Berlin)