Past BFGA Conferences

5th Conference on Behavioral Research in Finance, Governance, and Accounting (2023)

After four successful conferences in 2019, 2020, 2021 and 2022, the Graduate Center of the University of Giessen organized the 5th Conference on Behavioral Research in Finance, Governance, and Accounting – this year’s interdisciplinary annual conference of GGS which took place on November 03. Due to the attractiveness for international participants, this year's conference took place digitally as in 2022. For the fifth time in a row, the conference was a complete success.

As in the previous year, we received many promising manuscripts. After a thorough review process, we selected 20 papers out of 50 and organized six sessions of three to four papers each.

The conference started with a warm welcome by Professor Andreas Walter, head of the Organizing Committee and part of the Scientific Committee and of GGS. Following this, four interesting sessions took place, covering the topics of Behavioral Finance, Sustainable Finance, as well as Accounting and Corporate Finance & Governance.

After the lunch break, the conference continued with a highlight. Theresa Kuchler, Professor of Finance at New York University's Stern School of Business and Director of the Glucksman Institute for Research in Securities Markets, delivered her keynote speech titled "Social networks shape beliefs and behavior," providing interesting insights into her research. The remaining two sessions of the conference program were on Economics and Behavioral Finance.

All sessions were characterized by interesting presentations and fruitful discussions. Moritz Grebe, member of the Organizing Committee, presented two Best Paper Awards. Benjamin P. Yost and Enshuai Yu (Boston College) were awarded the overall best paper prize, generously sponsored by Union Investment, for their paper titled "Corner-Cutters Personally Tax Aggressive Executives and Corporate Regulatory Violations." In the sustainability category, the best paper award, sponsored by EB-SIM, was awarded to Karol Kempa and Ulf Moslener (FS-UNEP Centre, Frankfurt School of Finance & Management) for their paper titled “Environmental Externalities, Corporate Bonds, and the Role of Policy.” The conference ended with some concluding remarks by Professor Peter Tillmann, head of the Research Section BSFA.

Accepted Papers 2023

Session: Behavioral Finance I

Session Chair: Prof. Dr. Andreas Walter

1. It’s not What you Say, But How you Say It – Charismatic Rhetoric in Earnings Conference Calls

Authors: Wolfgang Breuer, Andreas Knetsch, Sami Uddin

Presenter: Andreas Knetsch

RWTH Aachen

2. Expectations and Attention to Experience

Authors: Heiner Beckmeyer, Ahmed Guecioueur

Presenter: Ahmed Guecioueur

INSEAD

3. Behavior on Blockchains: Trading Activity in Tokenized Financial Assets

Authors: Stefan Scharnowski

Presenter: Stefan Scharnowski

University of Mannheim

Session: Economics

Session Chair: Prof. Dr. Mirjam Stockburger

1. Spatial Extrapolation in Housing Markets

Authors: Gen Li

Presenter: Gen Li

University of British Columbia

2. Measuring Environmental Awareness: An Analysis Using Google Search Data

Authors: Amal Dabbous, Matthias Horn, Alexandre Croutzet

Presenter: Matthias Horn

Otto-Friedrich-Universität Bamberg

3. How Biased Survival Expectations Affect Financial and Health Behaviours?

Authors: Cristina Vilaplana-Prieto, Joan Costa-Font

Presenter: Cristina Vilaplana- Prieto

University of Murcia

Session: Behavioral Finance II

Chair: Prof. Dr. Peter Tillmann

1. Are Risk Preferences Stable for Impactful Financial Decisions?

Authors: Jorgo T.G. Goossens, Marike Knoef

Presenter: Jorgo Goossens, Radboud Univeristy Nijmegen

Tilburg University

2. Peer-Reviewed Theory Does Not Help Predict the Cross- section of Stock Returns

Authors: Andrew Y. Chen, Alejandro Lopez-Lira, Tom Zimmermann

Presenter: Alejandro Lopez-Lira

University of Florida

3. The Impact of Peer Performance on Individual Investors’ Trading Behavior

Authors: Nina Klocke, Daniel Müller, Tim Hasso, Matthias Pelster

Presenter: Daniel Müller

University of Duisburg-Essen

Session: Sustainable Finance

Chair: Prof. Dr. Oscar Stolper

1. Environmental Externalities, Corporate Bonds, and the Role of Policy

Authors: Karol Kempa, Ulf Moslener

Presenter: Karol Kempa

FS-UNEP Centre, Frankfurt School of Finance & Management

2. Climate Adaptation Disclosure: Does it Bring Home the Green?

Authors: Alessio Venturini, Alfonso Dufour, Len Shaffrey, Simone Varotto

Presenter: Alessio Venturini

ICMA Centre, Henley Business School, University of Reading

3. Common Ownership and Corporate Carbon Emissions

Authors: Liying Wang, Jingshu Wen, Jingyu Zhang

Presenter: Jingshu Wen

Said Business School, University of Oxford

4. Carbon Risk, Investment in Innovation, and Firm Value: International Evidence

Authors: Ismail Haidar

Presenter: Ismail Haidar

University of Texas Rio Grande Valley

Session: Accounting

Chair: Prof. Dr. Arnt Wöhrmann

1. Corner-Cutters: Personally Tax Aggressive Executives and Corporate Regulatory Violations

Authors: Benjamin P. Yost, Enshuai Yu

Presenter: Enshuai Yu

Boston College

2. The Impact of Technological Advances on Firms’ Reporting Choices

Authors: David Oesch, Tanja Walser

Presenter: Tanja Walser

University of Zurich

3. A Catering Theory of Earnings Guidance: Empirical Evidence and Stock Market Implications

Authors: Nils Lohmeier, Hannes Mohrschladt

Presenter: Nils Lohmeier

University of Münster

Session: Corporate Finance & Governance

Chair: Prof. Dr. Christoph Schneider

1. Corporate Venture Capital as Driver of Strategic Change? An Interorganizational Learning Perspective

Authors: Christian Schmidt, Christian Kaiser, Andreas Bausch

Presenter: Christian Kaiser

Justus Liebig University Giessen

2. Hierarchical Pay Incentives and Firm Performance: How do Firms Structure Pay Inside and Outside C-suites to Incentivize Performance?

Authors: D. Brian Blank, Jiawei Chen, Brandy Hadley, Valeriya Posylnaya

Presenter: Brian Blank

Mississippi State University

3. Why Are Opportunistic Stock-Financed Takeovers Accepted?

Authors: Nils Lohmeier, Christoph Schneider

Presenter: Christoph Schneider

University of Münster

4. Implicit Corruption with Subsidiaries: Evidence from Land Sales in China

Authors: Rose Neng Lai, Zongyuan Li, Yildiray Yildirim

Presenter: Zongyuan Li

Wenzhou-Kean University

Conference Committee

Prof. Dr. Oscar Stolper

Prof. Dr. Andreas Walter

Henrike Alm

Martin Becker

Moritz Grebe

Patrick Harmeth

Rebecca Sabel

Kathrin Stock

The conference was generously supported by:

4th Conference on Behavioral Research in Finance, Governance, and Accounting (2022)

After three successful conferences in 2019, 2020 and 2021, the Graduate Center of the University of Giessen organized the 4th Conference on Behavioral Research in Finance, Governance, and Accounting – this year’s interdisciplinary annual conference of GGS which took place on November 10-11. Due to the attractiveness for international participants, this year's conference took place digitally as in 2021. For the fourth time in a row, the conference was a complete success with more than 80 registrations.

As in the previous year, we received many promising manuscripts. After a thorough review process, we selected 20 papers out of 50 and organized six sessions of three to four papers each.

The first day of the conference started with a warm welcome by Professor Peter Tillmann, part of the Scientific Committee and of GGS. The rest of the program was followed by three interesting sessions on Behavioral Economics (two sessions), Economics and Sustainable Finance.

Just like last year, the second day started with the highlight of the conference. In her keynote speech "(Mis)perceptions about Investing", Christine Laudenbach, Professor of Finance at SAFE Leibniz Institute for Financial Research and Goethe University Germany, gave insights into her research. The remaining two sessions of the conference program were on Accounting & Governance and Corporate Finance.

All sessions were characterized by interesting presentations and fruitful discussions. Moritz Grebe, member of the Organizing Committee, presented two Best Paper Awards. The overall best paper award, generously sponsored by Union Investment, was given to Professor Peter Limbach (University of Bielefeld) and his coauthors for their paper "Does Speculative News Hurt Productivity? Evidence from Takeover Rumors". The best paper award in the field sustainability, sponsored by EB-SIM, was awarded to the paper "Every emission you create - every dollar you'll donate: The effect of regulation-induced pollution on corporate philanthropy" by Raphael Jonghyeon Park (University of New South Wales) and his coauthors. The conference ended with some concluding remarks by Professor Oscar Stolper, co-head of the Organizing Committee.

Accepted Papers 2022

Session: Behavioral Finance I

Session Chair: Prof. Dr. Andreas Walter

1. Mental Accounting and the Marginal Propensity to Consume

Authors: René Bernard

Presenter: René Bernard

Deutsche Bundesbank and Goethe University

2. Group Decisions and Asymmetric Payoffs: Risky Tax Avoidance in the Laboratory

Authors: Eva Matthaei; Dirk Kiesewetter

Presenter: Eva Matthaei

Freie Universität Berlin

3. Bank Manager Sentiment, Loan Growth and Bank Risk

Authors: Frank Brückbauer; Thibault Cézanne

Presenter: Thibault Cézanne

University of Mannheim & ZEW

Session: Economics

Session Chair: Prof. Dr. Peter Tillmann

1. Household Finance and Life Cycle Economic Decisions under the Shadow of Cancer

Authors: Daniel Kárpáti

Presenter: Daniel Kárpáti

Tilburg University

2. Higher order risk preferences (indirectly) predict economic decisions

Authors: Yilong Xu, Maarten Boksem, Charles N. Noussair, Stefan T. Trautmann, Gijs van de Kuilen, and Alan Sanfey

Presenter: Dr. Yilong Xu

Utrecht University

3. Inflation Expectations and Cognitive Uncertainty

Authors: Joscha Beckmann; Timo Heinrich; Jennifer Rogmann

Presenter: Jennifer Rogmann

FernUniversität in Hagen

Session: Behavioral Finance II

Chair: Prof. Dr. Oscar Stolper

1. Investor Sentiment and Sell-side Research Quality

Authors: Yangyang Chen, Kaizhao Guo , Jingshu Wen

Presenter: Jingshu Wen

University of Oxford

2. Headline Curiosity

Authors: Russell Golman; Jingyi Qiu

Presenter: Jingyi Qiu

University of Michigan, School of Information

3. Leverage constraints and investors' choice of underlyings

Authors: Matthias Pelster

Presenter: Prof. Matthias Pelster

Paderborn University

Session: Sustainable Finance

Chair: Prof. Dr. Andreas Walter

1. Every emission you create - every dollar you'll donate: The effect of regulation-induced pollution on corporate philanthropy

Authors: Simon Xu; Seungho Choi; Raphael Jonghyeon Park

Presenter: Raphael Jonghyeon Park

Haas School of Business, UC Berkeley

2. Sustainability: Performance, Preferences, and Beliefs

Authors: Valentin Luz; Victor Schauer; Martin Viehweger

Presenter: Victor Schauer

Ludwig-Maximilians-Universität München

3. Gender, performance, and promotion in the labor market for commercial bankers

Authors: Marco Ceccarelli; Christoph Herpfer; Steven Ongena

Presenter: Dr. Marco Ceccarelli

Maastricht University

Session: Accounting & Governance

Chair: Prof. Dr. Arnt Wöhrmann

1. Firm Opacity and Retail Investments in Attention Stocks and Lottery Stocks: Evidence from Robinhood Investors

Authors: Zhan Gao; Jacob J. Leidner; James N. Myers; Linda A. Myers

Presenter: Dr. Jacob J. Leidner

University of Würzburg

2. The Influence of Director Incentives on Directorship Portfolions

10:45am – 11:15am

Authors: Corinna Ewelt-Knauer; Hannes Gerstel; Mohoamed A. Khaled; Arnt Wöhrmann

Presenter: Hannes Gerstel

Justus Liebig University Giessen

3. The Economics of ETF Redemptions

Authors: Han Xiao

Presenter: Han Xiao

Pennsylvania State University

4. The Determinants and Consequences of Sustainability Incentives in CEO Compensation Contracts on CSP: European Evidence

Authors: Andreas Höhre

Presenter: Andreas Höhre

Justus Liebig University Giessen

Session: Corporate Finance

Chair: Prof. Dr. Peter Limbach

1. Does Speculative News Hurt Productivity? Evidence from Takeover Rumors

01:15pm – 01:45pm

Authors: Christian Andres; Dmitry Bazhutov; Douglas Cumming; Peter Limbach

Presenter: Prof. Peter Limbach

University of Bielefeld and CFR

2. The Information Value of M&A Press Releases

01:45pm – 02:15pm

Authors: Yang Cao; Florian Kiesel; Henry Leung

Presenter: Yang Cao

Grenoble Ecole de Management

3. Banks as "Anchors": The Role of Banks in Funding Innovation

Authors: Cristian-Mihail Condrea

Presenter: Cristian-Mihail Condrea

Frankfurt School of Finance and Management

4. How Close is Your Crowd? The Role of Information Asymmetries for Investment Decisions in Crowdinvesting

Authors: Moritz Sefried; Kristina Uhl

Presenter: Moritz Sefried

Eberhard Karls Universität Tübingen

Conference Committee

Prof. Dr. Walter

Prof. Dr. Stolper

Martin Becker

Jenny Bethäuser

Moritz Grebe

Patrick Harmeth

Sinem Kandemir

Fabio Martin

The conference was generously supported by:

3rd Conference on Behavioral Research in Finance, Governance, and Accounting (2021)

After two successful conferences in 2019 and 2020, the Graduate Center of the University of Giessen organized the 3rd Conference on Behavioral Research in Finance, Governance, and Accounting which took place on November 4-5. Due to the current circumstances caused by the Corona Pandemic, this year's conference took place digitally as in 2020. For the third time in a row, the conference was a complete success with more than 60 registrations.

As in the previous year, we received many promising manuscripts. After a thorough review process, we selected 15 papers and organized five sessions of three papers each.

The first day of the conference started with a warm welcome by Professor Andreas Walter, head of the Organizing Committee. The rest of the program was followed by three interesting sessions on Behavioral Economics (two sessions) and Sustainable Finance.

Just like last year, the second day started with the highlight of the conference. In his keynote speech "Skewness preferences - The human attitudes toward rare, high-impact risks", Sebastian Ebert, Professor of Microeconomics at the Frankfurt School of Finance and Management, gave insights into his research. The remaining two sessions of the conference program were on Managerial Accounting and Financial Markets & Accounting.

All sessions were characterized by interesting presentations and fruitful discussions. Sinem Kandemir and Moritz Grebe, members of the Organizing Committee, presented two Best Paper Awards. The overall best paper award, generously sponsored by Union Investment, was given to Nina Klocke (Paderborn University) and her coauthors for their paper "Dark Triad Personality Traits and Selective Hedging". The best paper award in the field sustainability, sponsored by EB-SIM, was awarded to the paper "The Influence of ESG Ratings on Idiosyncratic Risks: The Unrated, the Good, the Bad, and the Sinners" by Matthias Horn (Bamberg University). The conference ended with some concluding remarks by Professor Oscar Stolper, co-head of the Organizing Committee.

Accepted Papers 2021

Session: Behavioral Finance I

Session Chair: Prof. Dr. Andreas Walter

1. Does mining fuel bubbles? An experimental study on cryptocurrency markets

Authors: Marco Lambrecht, Andis Sofianos, Yilong Xu

Presenter: Yilong Xu (Utrecht University)

2. Stock Price Responses from Relative Competitive Strength: Evidence from European Soccer Matches

Authors: Andrea Schertler, Jarmo van Beurden

Presenter: Jarmo van Beurden (University of Groningen)

3. Ambiguity, Investor Disagreement, and Expected Stock Returns

Authors: Lawrence Hsiao

Unfortunately this presentation has to be canceled.

Session: Behavioral Finance II

Session Chair: Prof. Dr. Peter Tillmann

1. Attracted to Money and Risk: Evidence on the Personality of Finance Professionals

Authors: Max Deter, André van Hoorn

Presenter: André van Hoorn (Radboud University)

2. Entrepreneur Debt Aversion and Financing Decisions: Evidence from COVID-19 Support Programs

Authors: Mikael Paaso, Vesa Pursiainen, Sami Torstila

Presenter: Mikael Paaso (Erasmus University Rotterdam)

3. Dark Triad Personality Traits and Selective Hedging

Authors: Matthias Pelster, Annette Hofmann, Nina Klocke, Sonja Warkulat

Presenter: Nina Klocke (Paderborn University)

Session: Sustainable Finance

Session Chair: Prof. Dr. Peter Tillmann

1. Change my ESG history: Ex-post deletions and additions

Authors: Samuel Drempetic, Andreas Hoepner, Christian Klein

Presenter: Samuel Drempetic (University of Kassel / Steyler Ethik Bank)

2. The Influence of ESG Ratings on Idiosyncratic Stock Risk: The Unrated, the Good, the Bad, and the Sinners

Authors: Matthias Horn

Presenter: Matthias Horn (Bamberg University)

3. Sustainable Investment Timing under Career Concerns, Agency, and Information

Authors: Stefan Kupfer, Max-Frederik Neubert

Presenter: Stefan Kupfer (Otto-von-Guericke-University Magdeburg)

Session: Managerial Accounting

Session Chair: Prof. Dr. Arnt Wöhrmann

1. Individual Error Handling and Organizational Escalation of Commitment – A Comprehensive Analysis

Authors: Pia Gruber, Jennifer Kunz

Presenter: Pia Gruber (University of Augsburg)

2. General causality orientation and performance management – Taking a closer look at different professional fields

Authors: Tanja Gistl, Jennifer Kunz

Presenter: Tanja Gistl (University of Augsburg)

3. The Effect of Relative Performance Information on Knowledge Sharing among Employees

Authors: Christian Schnieder, Friedrich Sommer, Arnt Wöhrmann, Ivo Schedlinsky

Presenter: Ivo Schedlinsky (University of Bayreuth)

Session: Financial Markets & Accounting

Session Chair: Prof. Dr. Oscar Stolper

1. Deferred tax asset revaluations, costly information processing, and the stability of banks’ deposits: Evidence from the Tax Cuts and Jobs Act

Authors: Ulf Mohrmann, Jan Riepe

Presenter: Jan Riepe (Eberhard-Karls University Tübingen)

2. Geographic Proximity in Short Selling

Authors: Xiaolin Huo, Xin Liu, Vesa Pursiainen

Presenter: Xiaolin Huo (Renmin University of China)

3. Analyst Incentives and Stock Return Synchronicity: Evidence From MiFID II

Authors: Yihan Li, Xin Liu, Vesa Pursiainen

Presenter: Yihan Li (University of Bath)

Conference Committee

Prof. Dr. Walter

Prof. Dr. Stolper

Jenny Bethäuser

David Finck

Moritz Grebe

Patrick Harmeth

Sinem Kandemir

Fabio Martin

Darwin Semmler

Anisa Tiza-Mimun

Elena A. Tönjes

The conference was generously supported by:

2nd Conference on Behavioral Research in Finance, Governance, and Accounting (2020)

After last year’s successful conference, the Graduate Center of the University of Giessen organized the 2nd Conference on Behavioral Research in Finance, Governance, and Accounting which took place on October 22-23. Due to the current circumstances caused by the Corona Pandemic, this year’s conference took place digitally. With over 70 registrations, the conference was once again a complete success.

As in the previous year, we received many promising manuscripts. A thorough review process therefore ended in 12 accepted papers, which were divided into four sessions of 3 papers each.

The first day of the conference started with a warm welcome by Professor Christina Bannier, head of the organizing committee. This was followed by three sessions on Corporate Governance, Behavioral Economics and Behavioral Finance and Institutions.

The second day started with an exciting keynote speech by Steffen Andersen, Professor of Finance at the Copenhagen Business School, on Beliefs and Investment Biases. The last session of the conference was on Behavioral Finance and Investor Behavior.

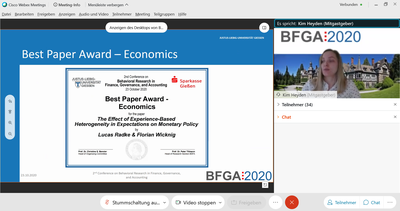

All sessions were characterized by interesting presentations and fruitful discussions. Kim Heyden, co-head of the research section, presented two Best Paper Awards, generously sponsored by Sparkasse Giessen. The awards were given to Florian Wicknig (Cologne University) for his paper ‘Experience-Based Heterogeneity in Expectations and Monetary Policy’, and to Alexander Kronies (Copenhagen Business School) for his paper ‘Skills and Sentiment in Sustainable Finance’. The conference ended with some concluding remarks by Professor Arnt Wöhrmann, co-head of the research section.

Conference Committee

Professors

- Prof Dr Christina Bannier

- Prof Dr Corinna Ewelt-Knauer

- Prof Dr Peter Tillmann

- Prof Dr Andreas Walter

- Prof Dr Peter Winker

- Prof Dr Arnt Woehrmann

Organization Team

The conference was generously supported by:

1st Conference on Behavioral Research in Finance, Governance, and Accounting (2019)

On October 7 - 8 2019, the research section Behavioral and Social Finance & Accounting at Justus Liebig University Giessen (JLU) organized the 1st Conference on Behavioral Research in Finance, Governance, and Accounting (BFGA 2019). The event took place at historic Schloss Rauischholzhausen, JLU's own little castle and probably by far the most attractive of all the university’s estates. With more than 50 participants, this first edition of BFGA was a complete success.

Following the call for papers, numerous manuscripts of high scholarly quality were submitted. A refereeing process led to a selection of 12 papers, which were presented over two days. Moreover, as the research section is part of the GGS, the Giessen Graduate Centre for Business and Economic Science, a special feature of the conference was that all papers were being discussed by JLU PhD students.

After a warm welcome by Prof Dr Christina E Bannier, Director of the GGS and Vice Dean at JLU's Business and Economics Faculty, day one comprised two sessions on Behavioral Finance and Corporate Governance. They were followed by the highlight of the first day, the keynote speech by Prof Dr Stefan Trautmann, Professor of Behavioral Finance at Heidelberg University and Associate Professor of Economics at Tilburg University. The last part on the first day's agenda was the conference dinner, which took place in the grand fireplace room.

Day two was all about Accounting and Economics. After two productive and interesting sessions, Prof Dr Peter Tillmann, Head of the Research Section, led to the final item on the agenda: The Best Paper Awards Ceremony. Generously sponsored by Volksbank Mittelhessen, Prof Tillmann awarded a Best Paper Award to two junior researchers, Ms Nora Lamersdorf (Goethe University Frankfurt) and Mr Fabian Brunner (University of Mannheim), for their outstanding work. Finally, he gave some concluding remarks about the conference and bade farewell to all conference participants.

Accepted Papers 2019

Session: Finance I

1. Till death (or divorce) do us part: Early-life family disruption and fund manager behavior

André Betzer, Peter Limbach*, P. Raghavendra Rau, and Henrik Schürmann

2. Reference-Dependent Return Chasing: Alpha, Losses and Fund Flows

Fabian Brunner

3. Streaks in Daily Returns

Alexandra Koehl, Alexander Klos*, Simon Rottke

Session: Finance II

1. Share repurchases, undervaluation, and corporate social responsibility

Nils Bobenhausen*, Andreas Knetsch, Astrid Salzmann

2. Mutual Fund Shareholder Letters: Flows, Performance, and Managerial Behavior

Alexander Hillert*, Alexandra Niessen-Ruenzi, Stefan Ruenzi

3. Empirical Studies on Gender Diverse Boards: Be Aware of the Value Bias in Corporate Debt

Jan Riepe*, Philip Yang

Session: Accounting

1. M&A Motives, Managerial Ambiguity, and Takeover Performance: less is more

Désirée-Jessica Pély

2. The effect of compensation interdependence on excessive risk taking – the role of mutual monitoring

Felix Bolduan*, Ivo Schedlinsky, Friedrich Sommer

3. The impact of individual audit partners on their clients' narrative disclosures

Christoph Mauritz, Martin Nienhaus, Christopher Oehler*

Session: Economics

1. Household Financial Risk Tolerance in Europe

Nora Laurinaityte

2. Financial Stability and the Fed: Evidence from Congressional Hearings

Arina Wischnewsky*, David-Jan Jansen, Matthias Neuenkirch

3. Effects of central bank communication on monetary policy transmission - A computational linguistics approach

Maximilian Düsterhöft, Nora Lamersdorf*

* marks the presenting participant

Conference Committee

Professors

- Prof Dr Christina Bannier

- Prof Dr Corinna Ewelt-Knauer

- Prof Dr Peter Tillmann

- Prof Dr Andreas Walter

- Prof Dr Peter Winker

- Prof Dr Arnt Woehrmann

Organization Team

The conference was generously supported by: